Shaping a products future: a vision piece for company wide alignment

ComplyAdvantage · December 2022

ComplyAdvantage is a financial crime compliance platform, used by many large financial institutions.

Along with a user researcher, we were conducted with the task of defining and shaping the future vision of the product. This included workshops with subject matter experts, stakeholder interviews, along with workshops with various team members.

We created a vision piece for the product, to help align the team on the future direction of the product. Whilst some of the details were highly speculative, the overarching ideas and user journeys were created to be a good starting point for the team to begin to design the future state of the product.

This led to the rebuild of multiple products into a single, unified product, saving the company money in development and infrastructure costs.

Timeframe: 2 months

My roles:

Product Design

Note: The videos below may skip over some flows and details to focus on the core concepts.

Screening & Case Management

An analyst at a financial institution would typically screen a new customer, and then flag any potential risks before onboarding them. They would typically be very busy and have an internal process to follow.

The new case management system would group related work together, and structure the alerts in an order that prevents analysts doing unnecessary work. Such checking if someone is sanctioned before checking adverse media, which is typically time consuming and wasted effort if the sanction screening comes back as a match.

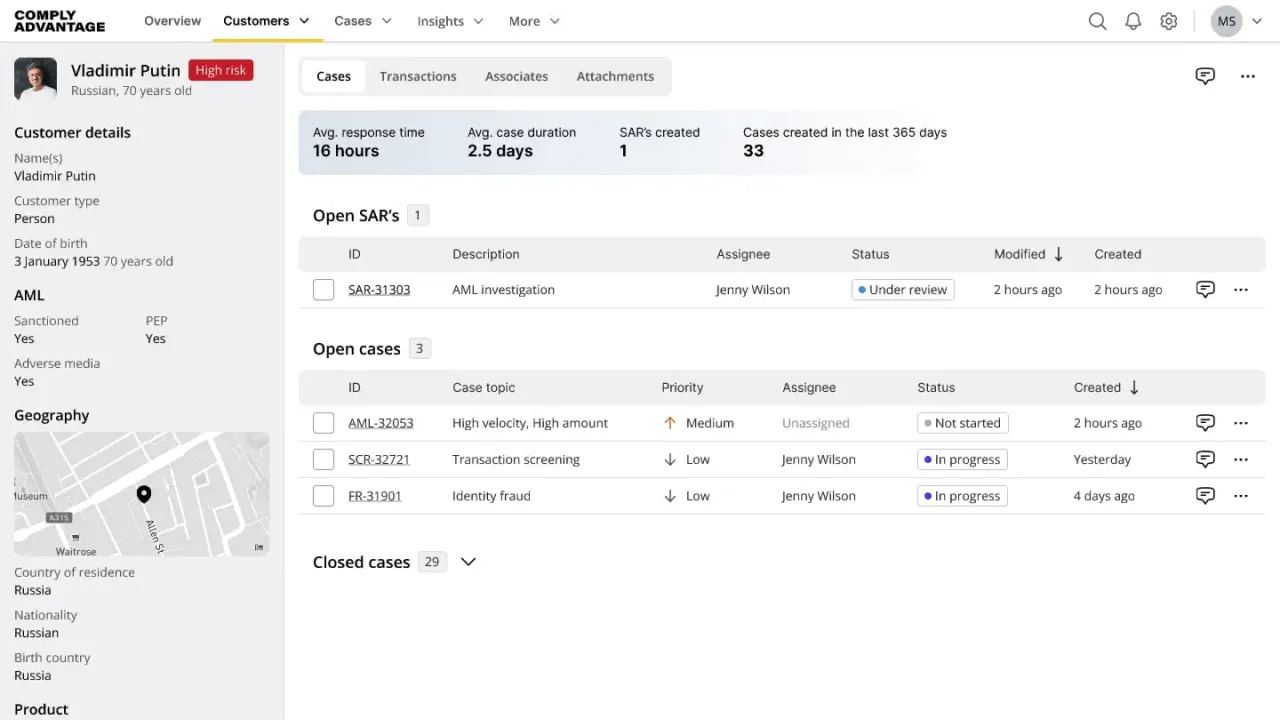

Customer View

When reviewing a potential customer, an analyst checks facts, and, if available, transaction history. Typically multiple platforms and sources are used to get a full picture of the customer.

A new client customer view, which would show facts on the customer, along with a summary of their transaction behaviour. Showing transaction volume, count and average size over time, was a huge pain point with clients.

The concept of a customer was unknown in the product before, it was only ever focused on the screening of an entity. Clients would often screen the same person multiple times to get up to date information and have to rely on keeping track of these entities elsewhere.

Whilst a rough concept, it proved more than good enough to get buy in internally and from existing and future clients to begin working on the new platform with a heavy focus on the concept of a customer in the platform.

Workflows

Users of different organisations would use multiple platforms and products, along with passing cases off to other team members before onboarding. Organisations would have their own internal processes and team sizes, causing data mismatches or duplication of work on various platforms.

The vision included a workflow builder, which would allow clients to build their own workflows. This would be a powerful feature, allowing clients to match their internal processes to the platform.

Queue Management

A new queue management system, which would allow clients to manage their own teams and their workloads.

In the previous product, my focus was mostly on transaction monitoring and case management, a queue manager was something thought up from experience speaking with mulitple clients and other users in the industry. The most common pain point was the time taken to set up work for analysts to do, and the inability for them to manage this themselves.

It’d allow team leads to focus on team performance and unblocking, rather than setting up work for analysts to do that week, allowing them to focus on the actual cases at hand rather than setting up work.

Organisation internal training

A highly speculative concept. Organisations that have multiple analysts typically have a high turnover, so training new employees was highly manual and repetitive. This concept was to allow organisations to create and manage their own training materials, along with recording high performers on working a case, so an analyst could learn from a real case scenario.

Jamie Lovelace

Jamie Lovelace